Helen Lawton Smith and Henry Etzkowitz

To date, neither studies of university spin-offs nor of venture capital have actually ‘followed the money’. In this paper, the money trail of a particular form of venture capital, university capital (UVC) is shown to be addressing “death valleys”, among, before and after offers from university angels (successful academic entrepreneurs), public and private venture capitalists. UVC is one element of an academic innovation system which intersects with other forms of venture capital and of regional funds related to local needs.

The paper traces the UVC money trail back to an early to mid-20th century regional development effort in the USA. It started with the American Research and Development Corporation (ARD) in 1946. This was the progenitor of the contemporary venture capital industry. It can be viewed as a hybrid entity in part an extension of the university (MIT and Harvard), as well as at the same time being an independent financial entity.

The money trail crosses the pond to the UK’s “Golden Triangle” (Oxford, Cambridge and London’s universities) with brief histories of university spin-off performance and of British venture capital as well as a case studies of the Universities of Cambridge and Oxford.

Next in China, the national UVC strategy and resource mobilisation practices demonstrate the pervasiveness of university entrepreneurship across all of China’s university system. This pervasiveness, and the money trail, is underpinned by the Chinese state. Unsurprisingly, but unlike in the US and the UK, the Chinese government takes the lead in mobilising resources to strengthen UVC’s role in academic entrepreneurship.

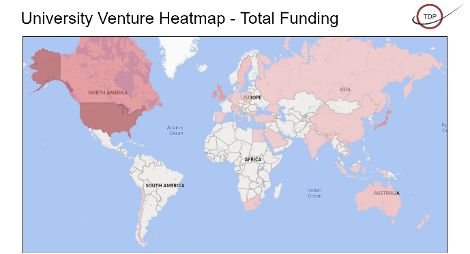

The heatmap below is one of a set. It illustrates university investment vehicles that are in the Venture Capital space by how they stack up globally. In each of them the United States is at the top of the list with the UK, Canada, and Japan also being in the top tier for all of them. Some differences are in the different types of indicators with China, Australia, and Sweden ranking near the top in exits and investment count, but not ranking in the upper tier in the others. These heatmaps show that, with the exception of Chile, Central and South America have been very limited in university involvement in the venture capital space. We can say the same thing for the continent of Africa with the exception of South Africa and Egypt. The Middle East, except for Saudi Arabia, Turkey and Central Asia are also missing in all of the areas measured in the heatmaps (exits, total funding and investment counts).

Data sources: TDPs propriety start-up dataset, TDP data systems.

As well as this geographical diversity in the money trail, the paper presents varieties of UVC, depending on the location of the university and its ability to generate start-ups with sufficient growth potential. Finally, the paper discusses different pathways to UVC – “immanent first and large scale second” – but ending up at the same place.

This paper is unique in the focus on international money trails of UVC. It was made possible by an internationally collaborative effort between scholars and practitioners in three countries – the US, UK and Finland.

Reference:

Etzkowitz, H., Weston-Smith, M., Beddows, J., Albats, E., Lawton Smith, H., Wilkinson, J., Yang, J., Miller,J.,Gardner, J., Palmer Foster, E and Zhou, C. (2023). University venture capital in big data, regional and historical perspective: where and why has it arisen? Venture Capital, DOI: 10.1080/13691066.2023.2184287

Very timely and insightful view into the international players & UVC resources.