In their new paper published in Regional Studies, Federica Rossi, Ning Baines and Helen Lawton Smith explain which features of regional economies make them more likely to retain and attract newly created university spinout companies.

The creation of innovative start-ups – including university spinout companies (henceforth USOs) – has been flagged as a way to revive the economy of lagging-behind regions, breathing new life into areas that have suffered from de-industrialisation and potentially playing a role in reducing regional inequality. Particularly in lagging-behind regions, exploiting knowledge resources from a local university as a launchpad for new enterprises seems an effective strategy. Policymakers have paid less attention to ensuring that USOs, once created, stay in their region of origin, or that other USOs are attracted to the region. But given that innovative start-ups, including USOs, are particularly mobile, a region’s ability to attract and retain existing USOs is as important as its ability to create USOs.

The so far neglected question of “what are the economic and institutional factors that help regions to attract and retain USOs?” has implications for regional development and the reduction of regional disparities.

Our study focuses on UK USOs, drawn from UK universities’ public websites. The analysis only considered USOs founded between 2005 and 2012, because of the need to restrict the focus on USOs that moved relatively recently (so that retention and attraction rates could be meaningfully correlated with regional economic variables) while allowing sufficient time for USOs to move.

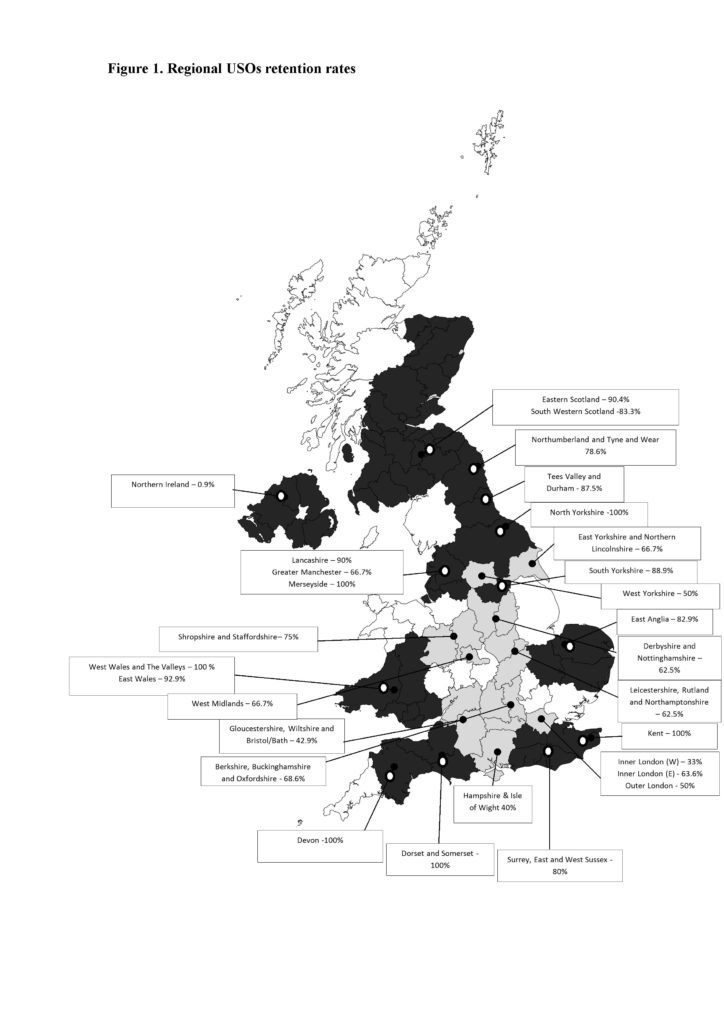

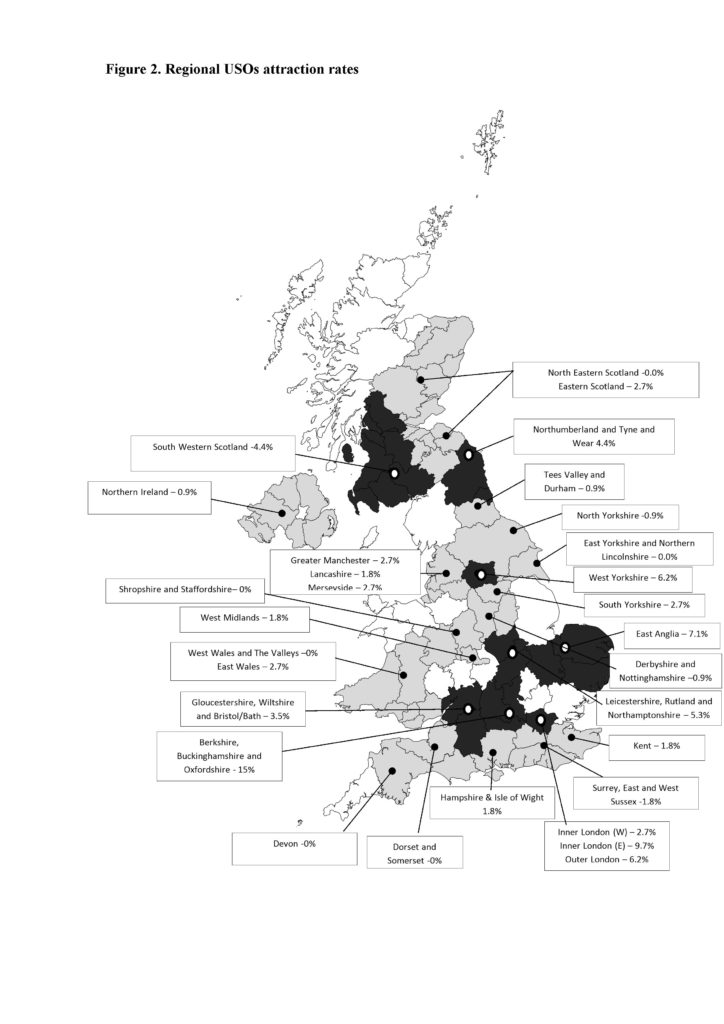

Retention and attraction rates of different regions

The majority of USOs stay in their region of origin: of the 931 active or acquired companies, 70.4% stayed in their university’s home region. Within the 408 USOs, different firm characteristics relate to a different propensity to remain. USOs in “trade” and ‘other’ sector are those that move the least, while manufacturing and chemical-pharmaceutical are the most mobile USOs. Regions with high retention rates are not necessarily those with high attraction rates, and vice versa. London and the South East, and to a lesser extent the East Midlands, have low retention and high attraction rates; the devolved countries, many regions in the North of England and in the South West, have high retention rates but low attraction rates. Some regions (West Midlands, some in the East Midlands and North of England) have low retention and low attraction rates. Finally, a few regions in the North East, East of England and Scotland have high retention and high attraction rates.

We also found that the features that increase retention rates are different from those that increase attraction rates. Some regions, (e.g. most of London and the South East), have low retention rates and high attraction rates, while others (e.g. the devolved countries) show the opposite pattern. USOs that stay and those that move appear to do so for different reasons. USOs that stay take advantage of the cheaper cost of inputs, irrespective of regional innovation resources (probably the benefit of home university’s innovation resources). Migrating USOs trade off proximity to the home university for access to innovation resources elsewhere, and for the opportunity to be closer to other companies in the same sector (localisation economies).

Determinants of USOs’ decisions to remain and move

Particularly, the different effects of the two types of agglomeration economies are presented. Urbanisation economies, leading to congestion effects and high input prices, reduce the likelihood of a USO staying, while localisation economies and innovation resources do not have an effect (home universities compensate for the deficit). Some resources provided by the university acting as anchor institutions are important. For migrating USOs, localisation economies increase the likelihood to move to a specific region, as USOs seek knowledge spillovers from other firms in the same sector. Innovation resources do not show an effect, although these seem to play a role when looking at region-level data.

Our study offers some general implications for industrial policy particularly related to the regional disparities reduction, for instance, in the UK’s “levelling up” agenda. USOs take advantage of the intangible resources provided by their home universities, indicating a key policy implication that industrial strategies and policies, which involve strengthening universities’ capacity to engage with local firms, specially USOs, will pay dividends. If USOs decide to move to other regions, available intangible resources are in the form of proximity to other companies from the same sector or a lively regional innovation ecosystem. A further implication is that industrial policies aiming to increase the USO retention and attraction rates of lagging regions, with a view to reduce regional disparities, should therefore capitalise on the fact that such regions generally do not experience urbanisation diseconomies (for example, congestion, and high prices), and invest in fostering the intangible resources that help make these regions more attractive to USOs.

The full paper is available as: Rossi, F., Baines, N. and H. Lawton Smith (2021) Which regional conditions facilitate university spinouts retention and attraction?, Regional Studies, Forthcoming special issue: Place-based Industrial and Trade Strategy