This post has been contributed by Dr Fred Guy (Birkbeck, University of London).

An earlier version of this post appeared in November 2019 (on https://frederickguy.com). Since then, the problem of monopoly – particularly, the platform giants we could call Big Tech: Apple, Amazon, Google, Microsoft, Facebook etc – has grown as a matter of public concern, with the US House of Representatives Subcommittee on Antitrust issuing a report calling for major reforms. Also, the research paper on which the blog post is based has now been published: Maryann Feldman, Frederick Guy, and Simona Iammarino. 2020. “Regional Income Disparities, Monopoly and Finance.” Cambridge Journal of Regions, Economy and Society rsaa024 (December). You can click through to that or, for the condensed, non-technical version, read on!

Note: An early version of the paper is available as a CIMR working paper: https://eprints.bbk.ac.uk/id/eprint/29484/

***

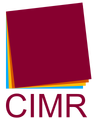

The map below shows where the higher paid jobs in the USA were concentrated in 2016; green is for greenbacks.

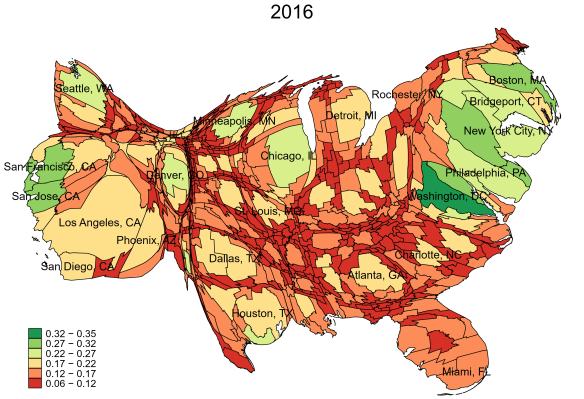

The shape of the map is funny. It is divided into what the Department of Commerce reckons to be “commuting zones”; each of these has been scaled, on our map, in proportion to its population. The color of each area shows the share of the workforce paid more than the 80th percentile worker in the USA. Overall, of course, 20% of the workforce gets paid more than the 80th percentile worker, so when your city (San Francisco, say, or Washington) is in the 30s, it’s got a lot of well-paid jobs; at the other end of the scale, with only around 10% of jobs above the 80th percentile, we see many rural areas and some de-industrialized cities of the Midwest. Compare this with the picture in 1980:

In 1980 some of those old industrial cities – Detroit, for example! – had a lot of well-paid jobs; Seattle, too, had a solid and heavily unionized old sector economy (it was unusual in making a transition from that, to having a secure place in the new monopoly world as home to both Microsoft and Amazon); Boston was in a bit of a slump.

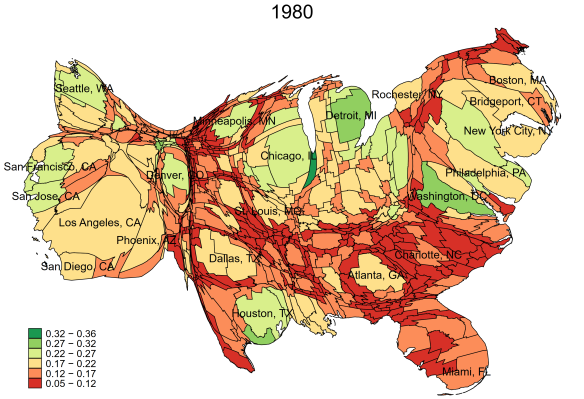

To make the comparison between 1980 and 2016 easier, we have a map showing the change in the local share of workers earning above the national 80th percentile:

You see there the collapse of the old industrial areas of the Midwest; the rise of tech clusters (San Francisco, Boston, and smaller ones like Austin – the dark green spot to the west (left) of Houston, and soon to be the new home of Silicon Valley’s Oracle; Madison – the green spot to the east of Minneapolis; and San Diego); the parallel rise of finance in New York (and note Charlotte, which became a banking center after North Carolina led the way on banking deregulation); and the rise (from what was already a high place) of Washington, D.C. If you ever wondered about the animus some in the flyover states hold for the coastal elite, there it is on a map.

I’ll come back to Washington, D.C. in a moment. First let me say something about tech clusters; then, something about other places, left behind places as they are sometimes called; and something about finance.

Technology clusters are actually monopoly clusters. This might not surprise you, since it is well known that (1) monopoly in the USA has grown greatly in many industries since 1980, (2) some of the biggest, strongest monopolies are digital platform (Google, Facebook, Amazon, Microsoft, Apple, Oracle, Adobe…), and (3) tech companies are often found clustered together. Yet, the standard academic understanding of tech clusters is that companies cluster together (and pay well) because workers in innovative companies in clusters are simply more productive than workers elsewhere. We say, No, not quite: the pay that draws skilled tech workers to these clusters is as high as it is because the skill and effort of these workers helps maintain the extremely lucrative monopolies of the big digital platforms. And, in addition to the big platforms, the tech clusters have a lot of start-ups; it is worthwhile for them to pay the high rents and high wages in the tech cluster, partly because it’s the best place to find investors and, later, to be bought out by one of the big platforms. These small start-ups need external equity financing, or to be taken over, for the same reason investors want to provide it: they have potential market power in some niche of the market, or have a tool useful for cementing the market power of an large platform, but the digital platform game is winner-take-all and if they are not scaled up quickly, another company will get there first. or, for start-ups (we think of start-ups as wanna-be monopolies), it is the best way to get the resources to get started, and then to find a big company to buy you out. Monopoly amplifies the benefits of locating in a very expensive city like San Jose or Seattle; it does this for the employees in the big tech firms, and for the owners and employees of start-ups. The presence of one or more tech giants thus gives the cluster a sort of gravitational pull for talent and start-ups, making it harder for little tech clusters to get going elsewhere.

Aside from keeping the lion’s share of good tech jobs for themselves, how do the monopoly clusters hurt the left-behind places? One way, of course, is that monopolies tax their customers. Microsoft maintains control of certain office applications (through its control of document formats) and PC operating systems: the world pays, and a disproportionate share of the beneficiaries live in the Seattle area. Facebook and Google control a shocking share of the world’s advertising revenues, and have consequently bled dry newspapers in most of the world. Amazon’s “marketplace” takes a cut from vendors, and then cherry picks their product lines for its own warehouses. Booking services – companies like Bookings.com, TripAdvisor, Airbnb, Uber and so forth – skim substantial sums from the revenues of hotels, restaurants and taxis, many of them very small businesses, around the world. Through its patents on genetically modified seeds, a company like Monsanto (now part of Bayer) can tax corn and soy bean farmers everywhere in the world.

(Notice that these companies we call monopolies all have competitors. How can they then be monopolies? Most of those mentioned are monopolies within particular networks. Just as a local water company has a monopoly within the area it serves, Microsoft has a monopoly among people who want to be able to open, edit and share Word files without any formatting problems; for the unemployed person with a car, Uber offers a monopoly gateway to a particular pool of paying customers; and so on.)

Another way tech monopolies hold back the left-behind is by denying them the ability to modify and develop the tools they have. Microsoft’s control of document formats and operating system APIs stifles the use of open source software by individuals and small businesses; Google and Apple do similar lock-downs of phone operating systems and of app markets. For both technical and legal reasons, open source software is far more customizable than the Microsoft or Apple products. If it were in more widespread use, we would see far more software applications developed in far more places.

We see the same problem with access to the most recent research results: the less wealthy colleges and universities, to say nothing of public libraries, cannot afford subscriptions to most academic journals. These are distributed digitally, and thus at zero marginal cost to the publisher, and are the main method of circulating the results of university research, research which has paid for largely with public money. The better-funded university libraries tend to be, not surprisingly, in the tech clusters.

The third way the monopoly clusters hold back the left behind is by draining away capital. A growing monopoly sector, with lots of wanna-be monopoly start-ups, offers investment opportunities which make other companies – companies competing in markets that cannot be locked down through control of a network or of some key intellectual property – look like plodders. And, because reforms to pensions, corporate governance, banking and securities markets between 1980 and the early 2000s made it easier for outsiders to pry money out of “underperforming” companies, assets are stripped from firms (and, often, their employees’ pensions) outside the monopoly sectors (and thus from places which aren’t the home of monopoly firms) and their pension funds, and then invest it in firms with monopoly prospects. Private equity companies play a particularly big role in this. Overall, the financial sector has changed from a sleepy one in the 1970s, to a turbulent (and highly paid) one today. Thus, we see New York’s share of good jobs (not a low share to begin with) rising between 1980 and 2016.

Now, Washington. Or, as Donald Trump liked to call it before he became President, The Swamp. Washington had a high share of well-paid jobs in 1980, and even so its increase in share from 1980 to 2016 has been among the highest in the country. It is not an important tech or financial cluster. But the different branches of the US government all play roles in the regulation of network industries and finance, the framing of intellectual property rights, and the enforcement of anti-trust law. The arrangements which have emerged since 1980, giving us very high levels of monopoly and a very powerful financial sector, have generated, and continue to generate, huge fortunes. Many of these fortunes flow from what economists would term, technically, rent: payments for something that would still be there or still get done if the payment wasn’t made. These companies and wealthy individuals will, and do, pay huge sums to persuade decision makers not to touch their rents, or better still to enhance them. Young journalists, political operatives, and lawyers go to work there, as do retired members of Congress and others who have had second careers prepared for them at the end of their public … service. (I was reminded of this, and moved finally to write this post, by two recent articles – Libby Watson’s in The New Republic piece and Andrew Perez’s in The American Prospect – on lobbyists against healthcare reform; health care reform, in the US context, threatens the combined market power of insurance companies, big pharma, and private hospital chains: lots of rent!)

There, then, is the triangle: monopoly, finance, and the influece peddling penumbra around the federal government that Donald Trump, in a great Don’t-throw-me-in-the-briarpatch performance, once denounced as The Swamp. They feed one another, and shut the left-behind places out in the cold. It is an easy problem to understand, but a rather more difficult one to fix.

***

Dr Fred Guy, Department of Management, Birkbeck, University of London